This version updated Dec 2018 to take on board comments following first publication.

Many private investors cringe at the mention of EBITDA by companies and some commentators denigrate EBITDA as “Bullshit earnings”. And yet the ratio of net debt to EBITDA remains one of the most common covenants that banks test for loan compliance and the ratio EV to EBITDA is still one of the most popular used by private equity funds when comparing companies. So who’s right, who’s wrong and can we reconcile the opposing views?

Bank Loan Documents

In the European loan market, the principle covenant that’s used to test the financial strength of a company is probably the “Leverage ratio”; this is the ratio of net debt to EBITDA. A high ratio implies a heavily levered company – one with lots of debt – whilst a low (or negative) ratio suggests low levels of debt relative to the implied ability of the company to service that debt.

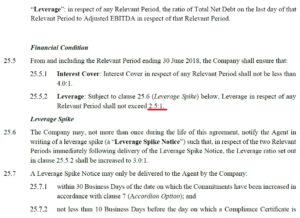

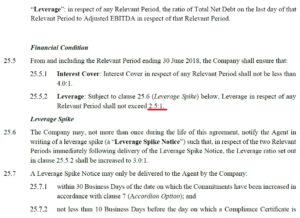

The extract below is from a recently agreed loan document of a UK listed company giving an example of how such a covenant might typically appear in a loan document:

Note the reference to a “Leverage Spike”, these are not that common and are usually used for acquisitive companies. But otherwise this language is market standard, based on documents prepared by the Loan Market Association, which is the industry body that promotes standard loan market practices and standard loan documents.

The Theory of EBITDA

The theory as to why this is a useful measure is based on the premise that EBITDA is a reasonable measure of the cash flow of a company before capex. Absent exceptional items (and yes the extract above shows “Adjusted EBITDA” rather than just “EBITDA”) then this is normally the case: EBITDA is a reasonable proxy for cash flow prior to capex.

Looking at the above example, where the leverage ratio would be expected to be a maximum of 3.0, the bank will have an expectation that, if there’s a default, then it should be able to step in and take control of the company, turn off the capex tap and get its cash back in 3 years.

This is the theory and it generally holds for companies with low mandatory capex. The obvious examples where it falls down are with companies that have high mandatory capex or significant tangible assets, such as for example Mitchells & Butler (“MAB” announced a leverage ratio of 4.0 times in its recent final results). However, the point with asset-heavy companies is that it’s more appropriate (from a bank perspective) to look at balance sheet ratios comparing debt to assets rather than to focus on cash flows (obviously you don’t ignore them entirely).

Is EBITDA and the leverage ratio useful for equity investors? No, probably not, other than to understand when a company might be getting close to breaching its bank covenants. Is it still right for a company like MAB to publish EBITDA and leverage ratios? Absolutely yes, accounts aren’t only for equity investors, banks and bondholders also read them!

As a quick final note, in European markets leverage of 3 times is normally the maximum for quoted companies (for those businesses where the focus is annual cash flow business). Above that level and banks get skittish. However, for asset heavy businesses, net debt to EBITDA is less of a concern and 6 times is more acceptable. 6 times is also the normal maximum leverage ratio for senior debt (note other subordinated debt might also be used) in a private equity buy-out. Both US and EU regulators have tried to limit maximum leverage in buy-outs to 6 times but it’s been creeping up above that of late. What this means is that if you can find a business trading at 6 times EBITDA (or below) then you have to ask the question: why hasn’t private equity bought this?

EBITDA Use by Private Equity

The private equity industry focuses heavily on the ratio of Enterprise Value to EBITDA when looking at companies. The ratio doesn’t have a specific name and the best abbreviation is simply “EV to EBITDA”. Some quick maths:

Multiple = EV / EBITDA

so: EV = Multiple x EBITDA

and since EV = Equity Value + Net Debt

then: Equity Value + Net Debt = Multiple x EBITDA

And: Equity Value = Multiple x EBITDA – Net Debt

Now that you’ve seen this last formula, you have 50% of everything that you need to bluff your way in the private equity industry!

When private equity looks at acquiring a company it doesn’t just think of how much it needs to pay for the equity, rather it looks at the total liabilities (the “Enterprise Value”). This is the equity that it will need to invest AND the debt that it will become responsible for (albeit with the benefit of limited liability). This is the rational way of looking at a company, in particular noting that private equity has many advantages over the retail investor, eg (1) PE will normally have voting control and control of the board, (2) PE will have better information flow (monthly management accounts), and (3) PE normally has deep pockets and has the option to put further equity into a company to reduce debt or restore compliance with covenants.

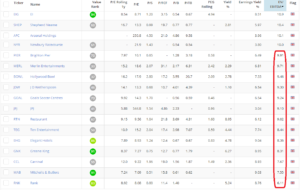

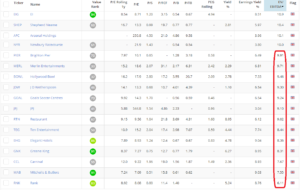

Private equity focuses on EV to EBITDA for various reason but the main one is that EV to EBITDA automatically adjusts for the differing debt positions of similar companies. This means that companies in the same sector can be easily compared, taking into account their differing debt levels, eg a quick look at Stockopedia shows Mitchells and Butler is much cheaper than Greene King, which in turn is cheaper than Wetherspoons:

Note that EV to EBITDA multiples are often sector specific so it makes sense to compare the multiple of companies within a sector but it makes little sense to compare multiples between different sectors.

As a final point, if mandatory capex can be easily identified then the calculation:

( EBITDA – mandatory capex ) / Enterprise Value

is a useful candidate for cash flow return on capital. Some will use EBITDA to EV as a cash flow return on capital but hopefully you can see why that’s dangerous!

Conclusion

EBITDA is simply one of many ratios that an investor should be aware of. EBITDA is used by banks as a proxy for cash flow and is used to test bank covenants. It’s important to understand this point since it will help to understand when a company might be under pressure from its banks. Also EV to EBITDA is a helpful tool to look at within sectors to identify relative measures of value.

EBITDA may have little relevance for equity investors but don’t forget that banks and bondholder also read the accounts and are interested in the number. However, if you find some small tinpot company talking about EBITDA to its equity investors then check the profit after tax; if that’s negative then you should query if management are focusing on the right number!